The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

Table of ContentsThe smart Trick of Hsmb Advisory Llc That Nobody is DiscussingThe 20-Second Trick For Hsmb Advisory LlcThe Best Guide To Hsmb Advisory LlcGetting The Hsmb Advisory Llc To WorkHsmb Advisory Llc for DummiesThe Hsmb Advisory Llc Diaries

Ford claims to guide clear of "cash value or permanent" life insurance, which is more of an investment than an insurance coverage. "Those are extremely complicated, come with high compensations, and 9 out of 10 people do not require them. They're oversold since insurance agents make the largest compensations on these," he says.

Impairment insurance can be costly. And for those that decide for lasting care insurance, this policy might make impairment insurance unnecessary.

Hsmb Advisory Llc - An Overview

If you have a chronic health and wellness problem, this kind of insurance policy might wind up being critical (Insurance Advise). Nonetheless, do not let it emphasize you or your financial institution account early in lifeit's typically best to take out a policy in your 50s or 60s with the expectancy that you will not be utilizing it up until your 70s or later on.

If you're a small-business owner, consider protecting your livelihood by buying organization insurance coverage. In the event of a disaster-related closure or period of restoring, company insurance coverage can cover your income loss. Think about if a substantial climate event affected your storefront or production facilityhow would certainly that impact your earnings? And for the length of time? According to a report by FEMA, between 4060% of tiny businesses never ever reopen their doors following a disaster.

And also, using insurance coverage can in some cases cost more than it conserves in the long run. If you get a chip in your windshield, you might consider covering the fixing cost with your emergency cost savings rather of your car insurance policy. Life Insurance.

Hsmb Advisory Llc Fundamentals Explained

Share these tips to safeguard enjoyed ones from being both underinsured and overinsuredand talk to a relied on expert when needed. (https://moz.com/community/q/user/hsmbadvisory)

Insurance that is purchased by an individual for single-person coverage or protection of a family members. The individual pays the costs, as opposed to employer-based health insurance where the employer often pays a share of the costs. Individuals may purchase and acquisition insurance policy from any kind of plans offered in the person's geographic region.

Individuals and households may get approved for economic assistance to reduce the expense of insurance premiums and out-of-pocket prices, however only when enlisting via Link for Wellness Colorado. If you experience particular changes in your life,, you are eligible for a 60-day time period where you can enlist in a private plan, also if it is beyond the yearly open registration duration of Nov.

The smart Trick of Hsmb Advisory Llc That Nobody is Talking About

- Connect for Wellness Colorado has a complete listing of these Qualifying Life Occasions. Reliant children who are under age 26 are qualified to be included as relative under a parent's protection.

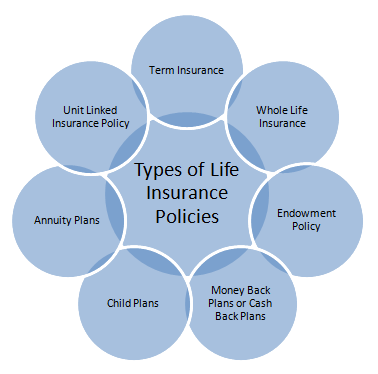

It may seem straightforward however recognizing insurance coverage types can likewise be confusing. Much of this complication originates from the insurance industry's continuous objective to create individualized protection for insurance policy holders. In developing versatile plans, there are a variety to pick fromand all of those insurance coverage types can make it tough to recognize what a specific policy is and does.How Hsmb Advisory Llc can Save You Time, Stress, and Money.

If you die throughout this duration, the individual or individuals you have actually called as my explanation beneficiaries may get the cash payout of the plan.

Lots of term life insurance policies let you convert them to a whole life insurance coverage plan, so you do not shed coverage. Normally, term life insurance policy policy premium payments (what you pay each month or year into your plan) are not locked in at the time of acquisition, so every 5 or 10 years you own the plan, your costs could rise.

They additionally have a tendency to be less expensive total than entire life, unless you purchase an entire life insurance policy policy when you're young. There are also a couple of variations on term life insurance coverage. One, called group term life insurance coverage, prevails amongst insurance options you might have accessibility to via your company.The Greatest Guide To Hsmb Advisory Llc

This is generally done at no price to the worker, with the ability to buy added protection that's obtained of the staff member's income. One more variant that you may have access to via your company is additional life insurance policy (Health Insurance). Supplemental life insurance coverage could consist of unexpected death and dismemberment (AD&D) insurance, or funeral insuranceadditional protection that can aid your family members in instance something unforeseen occurs to you.

Irreversible life insurance coverage merely refers to any kind of life insurance coverage plan that does not run out.